Abstract

While multinational enterprises (MNEs) are widely recognized for providing employment to a significant number of women around the globe, empirical evidence suggests that existing gender inequalities may be aggravated rather than alleviated in their subsidiaries. We build on gender theory to better understand how gender is construed and enacted differently in MNE subsidiaries compared to domestic firms, particularly with regard to the differential effects of parenthood on wage gaps for male versus female employees. Because of the relatively more demanding working conditions in MNE subsidiaries and their gendered policies and practices, we hypothesize that the motherhood penalty and fatherhood bonus are larger in MNE subsidiaries than in domestic firms. Using an extensive database of micro-level data of over 36,500 employees in 57 countries, we find a larger fatherhood bonus in MNE subsidiaries compared to domestic firms, but no significant difference in the motherhood penalty. Our results suggest that shifting entrenched gendered social beliefs and divisions of household labor is not the only pathway to gender equality, and call for a critical examination of gender-related values, perceptions, policies, and practices in MNEs, beyond a focus on supporting women (with children). We discuss managerial, theoretical, and societal implications accordingly.

Plain language summary

In a world where multinational enterprises (MNEs) employ a significant number of women globally, it is crucial to comprehend how these enterprises impact gender inequality. Studies have indicated that MNEs can sometimes intensify existing gender disparities, such as the gender wage gap (the difference in pay between men and women). However, a particularly understudied area is how parenthood influences wages differently in MNE subsidiaries (companies owned and controlled by the MNE) compared to domestic firms (companies operating within a single country). This study investigates whether the "motherhood penalty" (lower wages for mothers compared to women without children) and "fatherhood bonus" (higher wages for fathers compared to men without children) are more pronounced in MNEs. The authors created a dataset from the WageIndicator survey, which includes over 36,500 employees from 57 countries. The research utilized advanced statistical methods to analyze the data, considering both industry- and country-level influences on wages. The study provides a comprehensive look at how parenthood and employment in MNE subsidiaries versus domestic firms affect wages. The research discovered that fathers working for MNE subsidiaries receive a significantly larger "fatherhood bonus" compared to those in domestic firms. However, the "motherhood penalty" was present in both MNEs and domestic firms, with no significant difference between the two. This suggests that while MNEs may offer fathers additional wage premiums, they do not necessarily worsen the wage penalty for mothers. This insight advances our understanding of gender inequality in the workplace and suggests that MNE-specific policies and practices play a role. The potential impact of these findings is significant, as they can inform policies within MNEs and contribute to the broader discussion on gender equality in the workplace. This text was initially drafted using artificial intelligence, then reviewed by the author(s) to ensure accuracy.

Résumé

Même si les entreprises multinationales (Multinational Enterprises – MNEs) sont largement reconnues pour fournir des emplois à un nombre important de femmes dans le monde, des preuves empiriques suggèrent que les inégalités existantes entre les sexes peuvent être aggravées plutôt que atténuées dans leurs filiales. S’appuyant sur la théorie des genres, notre recherche vise à mieux comprendre comment le genre est interprété et mis en œuvre différemment dans les filiales des MNEs par rapport aux entreprises domestiques, plus particulièrement en ce qui concerne les impacts différentiels de la parentalité sur les écarts salariaux entre les employés masculins et féminins. En raison des conditions de travail relativement plus exigeantes dans les filiales des MNEs et de leurs politiques et pratiques sexospécifiques, nous émettons l’hypothèse que la pénalité de maternité et la prime de paternité sont plus importantes dans les filiales des MNEs que dans les entreprises domestiques. Utilisant une large base de données microéconomiques sur plus de 36500 employés dans 57 pays, nous constatons une prime de paternité plus importante dans les filiales des MNEs que dans les entreprises domestiques, mais aucune différence significative dans la pénalité de maternité. Nos résultats suggèrent que le changement des croyances sociales liées aux genres bien ancrées et des divisions du travail domestique n’est pas la seule voie vers l’égalité des sexes, et appellent à un examen critique des valeurs, perceptions, politiques et pratiques liées aux genres dans les MNEs, au-delà de l’accent mis sur le soutien aux femmes (avec des enfants). Nous discutons en conséquence des implications managériales, théoriques et sociétales.

Resumen

Mientras que las empresas multinacionales son ampliamente reconocidas mundialmente por dar empleo a un número significativo de mujeres, la evidencia empírica sugiere que las actuales desigualdades de género en sus filiales pueden agravarse en lugar de mejorarse. Basándonos en la teoría de género para entender mejor cómo el género es interpretado y promulgado diferente en las filiales de las empresas multinacionales en comparación con las empresas locales, de manera particular con relación a los efectos diferenciales de la paternidad en las brechas de género para hombres con relación a las empleadas mujeres. Dado a que las condiciones laborales en las filiales de las empresas multinacionales son más demandantes y las políticas con perspectiva de género, formulamos la hipótesis que la penalidad de la maternidad y las bonificaciones de paternidad son más altos en las filiales de las multinacionales que en las empresas locales. Usando una amplia base de datos de más de 26.500 empleados en 57 países, encontramos una mayor bonificación en las filiales en comparación con las empresas domésticas, sin embargo, no hay una diferencia significativa en la penalidad de la maternidad. Nuestros resultados sugieren que cambiar las arraigas creencias de género y las divisiones de las funciones en el hogar no es la única vía para la igualdad de género, y exigen un examen crítico de los valores, percepciones, políticas y prácticas relacionados al género en las multinacionales, más allá de enfocarse en darle apoyo a las mujeres (con hijos). Por consiguiente, discutimos las implicaciones gerenciales, teóricas y para la sociedad.

Resumo

Embora empresas multinacionais (MNEs) sejam amplamente reconhecidas por proporcionarem emprego a um número significativo de mulheres em todo o mundo, a evidência empírica sugere que existentes desigualdades de gênero podem ser agravadas em vez de atenuadas em suas subsidiárias. Baseamo-nos na teoria de gênero para melhor compreender como o gênero é interpretado e aplicado de diferentes formas em subsidiárias de MNEs em comparação com empresas nacionais, particularmente no que diz respeito aos efeitos diferenciais de parentalidade nas diferenças salariais entre trabalhadores masculinos e femininos. Devido às condições de trabalho relativamente mais exigentes em subsidiárias de MNEs e suas políticas e práticas de gênero, levantamos a hipótese de que a penalidade por maternidade e o bônus de paternidade são maiores em subsidiárias de MNEs do que em empresas nacionais. Utilizando uma extensa base de dados de dados a nível micro com mais de 36.500 trabalhadores em 57 países, encontramos um bônus de paternidade maior em subsidiárias de MNEs em comparação com empresas nacionais, mas não há diferença significativa na penalidade por maternidade. Nossos resultados sugerem que a mudança de arraigadas crenças sociais de gênero e de divisões do trabalho doméstico não é o único caminho para a igualdade de gênero, e demandam um exame crítico de valores, percepções, políticas e práticas relacionadas sobre gênero em MNEs, para além de um foco no apoio a mulheres (com filhos). Assim, discutimos implicações gerenciais, teóricas e sociais.

摘要

虽然跨国企业 (MNE) 因向全球相当数量的女性提供了就业机会而受到广泛认可, 但实证证据表明, 其子公司中现有的性别不平等现象可能在加剧而不是缓解。我们以性别理论为基础, 更好地理解MNE的子公司对性别的解释和规定与国内企业相比有何不同, 特别是在父母身份对男性与女性员工工资差别的差异影响方面。由于MNE的子公司相对更严格的工作条件及性别政策和做法, 我们假设, MNE子公司的母亲惩罚和父亲奖金比国内企业大。通过使用包含了 57 个国家超过 36,500 名员工的微观层面数据的广泛数据库, 我们发现与国内企业相比, MNE子公司的父亲奖金更高, 但母亲惩罚没有显著的差异。我们的研究结果表明, 改变根深蒂固的性别化的社会信仰和家庭劳动分工并不是实现性别平等的唯一途径, 并呼吁对与性别相关的MNE的价值观、观念、政策和实践进行严格审视, 而不仅仅是对女性(与孩子)支持的关注。我们相应地讨论了对管理、理论和社会的启示。

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Multinational enterprises (MNEs) are widely recognized for providing employment to a significant number of women in their subsidiaries around the globe (UN, 2020). However, research has shown that MNEs – like other types of organizations – are gendered (Koveshnikov et al., 2019), with empirical evidence suggesting that existing gender inequalities may be aggravated rather than alleviated in their subsidiaries. For instance, the gender wage gap was found to be larger in MNE subsidiaries than in domestic firms in developing countries (Van der Straaten et al., 2020), and only 17% of employees in the subsidiaries of the world’s largest MNEs are female (UN, 2020). This incites questions on how gender inequality is shaped differently in MNE subsidiaries compared to domestic firms (Fitzsimmons et al., 2023).

A highly salient source of gender inequality in the workplace that has thus far received little scholarly attention in the international business (IB) field is the inequity associated with parenthood. Sociologists have empirically shown the existence of a so-called “motherhood penalty”, i.e., that mothers earn less than their childless female peers. These studies suggest this wage gap could be due to reduced productivity at work as a result of demanding tasks at home (Budig & England, 2001). An alternative explanation is that mothers face biases in the workplace: as mothers are believed to be less dedicated and flexible compared to their childless peers, they are more likely to be perceived as less productive (and rewarded less accordingly). Fathers, conversely, have been seen as having greater work commitment, stability, and deservingness than their childless peers. Empirical studies have shown that fathers receive a “fatherhood bonus”, i.e., they are paid more than their childless male peers (Hodges & Budig, 2010).

Building on these insights, our study brings parenthood wage gaps (the motherhood penalty and fatherhood bonus) to the IB context and asks whether parenthood wage gaps are larger in MNE subsidiaries compared to domestic firms. Accordingly, we focus on two well-defined types of firms: MNE subsidiaries and domestic firms with neither foreign ownership nor foreign subsidiaries. We develop and test hypotheses on how foreign ownership moderates the relationship between parenthood and wages. We posit that the likelihood of work–life conflicts is higher for mothers working for MNE subsidiaries (compared to domestic firms), because their work environment is more intense and demands more flexibility. Conversely, for fathers working in MNE subsidiaries, the nature of working across borders, and the concomitant selection, valuation, and compensation, may result in an additional wage premium compared to their childless peers in domestic firms. Moreover, we expect the overvaluation of fathers and undervaluation of mothers to be higher in MNE subsidiaries, as MNEs have been suggested to be firms in which biases in favor of men and masculine traits, such as fatherhood, are more salient (Hodges & Budig, 2010; Koveshnikov et al., 2019). Accordingly, we hypothesize a larger motherhood wage penalty and fatherhood wage bonus in MNE subsidiaries compared to domestic firms.

We test these hypotheses by constructing a dataset from the WageIndicator survey. The dataset contains the wages and characteristics of over 36,500 employees in 57 countries. The analysis corroborates the presence of a significantly larger fatherhood bonus in MNE subsidiaries compared to domestic firms. However, while there is a motherhood penalty in MNEs, it is not significantly different from the motherhood penalty in domestic firms.

Our study contributes to the literature in several ways. By combining theory from sociology and IB, it advances our understanding of parenthood wage gaps in MNE subsidiaries (vs. domestic firms) and the related role of MNE-specific gendered policies and practices. Moreover, MNEs are organizations where home- and host-country constructions of gender intersect and, to the best of our knowledge, the consequences of this intersection for gender inequality have not been considered in a larger-scale empirical setting; here we also contribute. Empirically, our work employs cross-classified multilevel effects modeling, allowing us to control for all industry- and country-level characteristics that contribute to gender-related differences in wages (Graafland & Noorderhaven, 2020; Peterson et al., 2012).

Theory and hypotheses

To advance our understanding of how gender inequalities are (re)created in MNE subsidiaries, we build on insights from social sciences, considering MNE subsidiaries as “gendered” organizations, as put forward by Koveshnikov et al. (2019). In this body of work, constructions of gender include the norms, behaviors, roles, and relations associated with men, women, masculinity, and femininity, which can vary considerably between social settings. Considering organizations to be gendered entails that constructions of gender can also vary considerably between workplaces (Acker, 1990). These firm-level constructions of gender are deeply embedded in organizational policies and practices (Acker, 2006), implying that firms, as employers, influence the (re)creation of gender inequalities (Acker, 2006; Bidwell, et al., 2013). For instance, in hiring and promotion decisions, women are often at a disadvantage because managers are biased to perceive them as secondary earners prevented from being fully dedicated to their jobs, and consequently their productivity and performance tends to be underestimated (Blau & Kahn, 2017).

Building on the assumption that there are variations in how gender is constructed and materializes in firms, and on sociology and IB research, we expect gender inequality to be more salient in MNE subsidiaries compared to domestic firms. To start with, MNEs tend to have relatively formal hierarchical structures with global performance appraisal and compensation systems. These human resource management (HRM) practices are of strategic importance and therefore tend to be organized and controlled centrally and diffused to subsidiaries (Van der Straaten et al., 2020). In hierarchical organizations with performance-based reward systems, biases against women (and the associated underestimation of their performance), may have the most salient effects (Acker, 2006; Amis et al., 2020).

Moreover, some authors expect biases in favor of men and masculinity to be stronger in MNEs, due to the relatively higher level of risk-taking needed for the exploration and exploitation of growth opportunities in complex contexts abroad. These characteristics are perceived as masculine, and constructed as less likely associated with women and femininity (for an overview, see Koveshnikov et al., 2019). The low share of 17% female employees in the world’s largest MNEs adds to expectations of men and masculinity being the norm in MNEs and their subsidiaries (UN, 2020). In a more masculine corporate environment, the fit and performance of women is likely to be underestimated to an even larger degree than in more feminine organizations (Acker, 1990).

For MNE subsidiaries specifically, the intersection of (often divergent) home- and host-country gender constructions has been identified as a distinctive feature affecting gender inequality. Single-country comparisons were made by Fitzsimmons, Baggs, and Brannen (2020) and Kodama, Javorcik, and Abe (2018), with the former finding internationally oriented firms have a higher gender wage gap than domestic firms in the context of Canada, and the latter showing MNEs are more likely to hire and promote women compared to locally owned firms in Japan. In a multi-country study, Van der Straaten et al. (2020) found a smaller gender wage gap in MNE subsidiaries (compared to domestic firms) in developed countries, but a larger gender wage gap in MNE subsidiaries in developing countries. Based on their findings, all three studies suggest – but do not test – gender inequality in MNE subsidiaries is highly contingent on differences between the subsidiaries’ host countries compared to home countries.

Considering the above, we expect a differential effect in gender inequality in MNE subsidiaries compared to domestic firms, which extant IB literature has not investigated in more detail, especially when it comes to those inequalities related to parenthood and, specifically, the motherhood penalty and fatherhood bonus – concepts extensively studied in sociology. Thus, in the next subsections, we develop hypotheses on the motherhood penalty and fatherhood bonus in MNE subsidiaries compared to domestic firms (cf. Table 1).

The motherhood penalty in MNE subsidiaries

The wage penalty associated with motherhood and its possible causes has been widely discussed in the literature, primarily in sociology.Footnote 1 Empirically, the penalty of becoming a mother is estimated to be between 4% and 13% after controlling for job and individual characteristics (Cukrowska-Torzewska & Matysiak, 2020). Sociology studies have suggested several explanations for the existence of the motherhood penalty. The first is the so-called “time incompatibility” of paid labor and childcare. On average, mothers take on the majority of childcare within the household, which makes it especially hard for them to combine their paid labor with the time and scheduling demands of parenthood such as opening hours of daycare, school hours, and extracurricular activities. This may cause their productivity, and consequently their wage, to suffer accordingly (Budig & England, 2001; Budig & Hodges, 2010). A second possible (partial) explanation is based on the presumption that a mother’s productivity at work may be affected because childcare and paid work compete for her energy and concentration. The relevance of this decreased “work effort” mechanism is expected to increase with the intensity of both parenting and job tasks (Cukrowska-Torzewska & Matysiak, 2020).

Working in an international environment requires a relatively higher level of flexibility – compared to working for a purely domestic firm – such as availability outside regular business hours to communicate with people in other time zones and/or for international travel, often on short notice (Bøler et al., 2018; Hewlett & Rashid, 2010). Moreover, due to the need to transfer and exploit firm-specific advantages in a complex multinational context, jobs in MNEs tend to require relatively higher levels of cognitive skills (Narula & Van der Straaten, 2021). This higher intensity and the demands of jobs in MNE subsidiaries could amplify the negative “time incompatibility” and “work effort” effects of having children on the perceived productivity of mothers working for MNEs, and the motherhood penalty may therefore be relatively larger in MNEs compared to domestic firms.

A third explanation for the motherhood penalty, also established in sociology research, is that, given limited information about an employee’s productivity, employers may rely on perceptions of group differences in productivity based on motherhood status, on top of gender, and discriminate accordingly (Correll et al., 2007). In relatively more masculine work environments, such as MNEs (Koveshnikov et al., 2019), these biases in favor of men, and against mothers, have been found to be stronger (Hodges & Budig, 2010). Moreover, Goldin’s (2014) Nobel Prize-winning work posits that, especially in organizations that demand long hours, continuity and flexibility, employers associate motherhood with less motivation and commitment, and as a signal of unwillingness to work hard. This could lead to a relatively higher motherhood penalty in MNE subsidiaries, due to assumptions of mothers’ lower perceived, rather than actual, productivity. Combined with the aforementioned work effort and time demands associated with working for an MNE subsidiary, we hypothesize:

Hypothesis 1

All else equal, the motherhood penalty is larger in MNE subsidiaries than in domestic firms.

The fatherhood bonus in MNE subsidiaries

An additional dimension of gender inequality is the wage premium that fathers receive because of their parental status. This fatherhood bonus is estimated to be between 3% and 10% (Fuller & Cooke, 2018). To explain this premium, sociology literature has put forward one main mechanism, which is that positive biases associated with fatherhood and breadwinning in organizations may lead employers to favor fathers over childless men: fathers are perceived as the most motivated, dedicated, hard-working, dependable, and loyal employees (Fuller & Cooke, 2018; Hodges & Budig, 2010). Fathers may accordingly be given more opportunities to demonstrate their abilities, be rewarded more for achievements compared to their childless and female peers, or receive less scrutiny for poor performance (Fuller & Cooke, 2018; Hodges & Budig, 2010).

Biases in performance assessment may have more significant effects on wages in organizations with hierarchical, performance-based HRM systems (Acker, 2006; Amis et al., 2020), such as MNEs (Van der Straaten et al., 2020). Moreover, as highlighted earlier, the positive bias towards men and masculinity has been suggested to be especially salient within MNEs (Koveshnikov et al., 2019). Accordingly, we expect both the overvaluation of masculine characteristics, including fatherhood, and its implications for wages, to be higher in MNE subsidiaries compared to domestic firms.

Additionally, specific characteristics of working for an MNE subsidiary may also affect the fatherhood bonus. In MNE subsidiaries, many employees are global professionals, i.e., they either regularly interact with others across borders, travel internationally, and/or have taken on expatriate assignments (Shaffer et al., 2016). Men, in particular those with families, are overrepresented in these roles (e.g., over 80% of expatriates are men, and over 80% of these men have families (McNulty & Selmer, 2017; Shaffer et al., 2016)), as traditional gender roles make it easier for them to reconciliate working outside of office hours, being away from home, and relocate, compared to women. Moreover, men have a higher chance of being selected for these roles, based on their perceived suitability (McNulty & Selmer, 2017). This perceived suitability may be even higher for fathers because of the aforementioned effect of fatherhood to signal stability and responsibility (Fuller & Cook, 2018). Considering the relatively more generous reward and compensation schemes for international roles and expatriate assignments, and additional compensation for fathers relocating with their families (McNulty & Selmer, 2017), this could result in a higher wage premium for fathers in MNE subsidiaries, compared to their peers in domestic firms.

Based on the overrepresentation of men with families in global roles, the associated compensation schemes, and positive perceptions of their performance, we hypothesize:

Hypothesis 2

All else equal, the fatherhood bonus is larger in MNE subsidiaries than in domestic firms.

Empirical analysis

The sample

Our sample is derived from employee-level surveys included in the “WageIndicator” database. We considered the WageIndicator surveys that measured the variables relevant for this study; they were completed between January 1, 2013, and December 31, 2015. Data on the variables relevant to our hypotheses were available for employees from 21 agricultural, manufacturing, and service industries in 57 countries (for more information on the dataset and the full list of countries, see the online appendix). The total sample contains 36,567 employees. Of the respondents, 53.8% was male and the average age in the sample was 36.4 years (sd = 10.8 years).

Methodology

Through econometric analysis, we aimed to estimate the effect of working for an MNE on the size of the motherhood penalty and fatherhood bonus. Given that we thereby test the effect of having children in domestic firms versus MNEs by gender, we split the sample by gender and then test the interaction between MNE and parenthood status (Children). To estimate these effects, we follow Bøler et al. (2018), and employ a Mincerian-type wage regression, which accounts for the non-linear effect of experience on wages, i.e., we add an exponential term for Experience in our models. Moreover, the regression model is multilevel, as we expect both industry and (host) country to influence employee wages, and employee-level observations are therefore not independent (Peterson et al., 2012). This approach allows us to account for the observable and unobservable characteristics of the industry and host country influencing wages. As the random effects of country and industry are crossed random effects (i.e., country and industry are not nested in hierarchy), we employed cross-classified random coefficient models (CCRCM): we model a three-level model where employees (level 1) are hierarchically nested in industries at the second level, and cross-classified in countries at the third level (Graafland & Noorderhaven, 2020).Footnote 2

Variables

In this subsection, we describe the variables used in the analysis.

Dependent variables

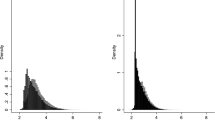

The dependent variable Wage corresponds to the employee’s gross hourly wages in $US at purchasing power parity. The mean hourly wage (at PPP) was $11.47 with a standard deviation of $2.66. As the data were skewed, we performed a log transformation to approximate a normal distribution.

Independent variables

We measure whether an employee is employed by an MNE subsidiary with a dummy variable MNE (1 = employed by a subsidiary of a foreign MNE; 0 = employed by a domestic firm that has no foreign ownership nor subsidiaries in foreign locations). Gender is measured by a dummy variable (Female: 0 = male, 1 = female); and parenthood status by a dummy variable (Children) that indicates whether the employee has one or more children.

Control variables

We use individual-level control variables that include employees’ managerial position, experience, level of education, and union membership, as well as firm and host-country level controls. Following Abraham (2017), managerial position (Supervisor) is measured by the number of subordinates of the employee (where 0 = no supervising role) and the control variable Education is based on the employee’s ISCED-1997 education level and measured on a scale from 0 (no education) to 6 (upper tertiary education). Experience is measured by the employee’s work experience in years. Union is a dummy variable, with 0 indicating the employee is not member of a union, and 1 indicating union membership. Firm size is measured in classes ranging from 0 (self-employed without personnel) to 10 (5000 or more employees). Women measures the percentage of women in the firm for which the employee works, in discrete classes ranging from 0 (no women) to 11 (100% women), where each 1-unit increase in the class corresponds to an increase of 10 percentage points in the percentage of women in the firm (e.g., 1 = 1–10%, 2 = 11–20%), as social (gender) constructions can be concomitant to majority groups in the firm (Amis et al., 2020).

We considered the main indices for gender inequality to examine the moderating role of the distance in gender equality between the MNE home and host country. As the 2014 UNDP’s Gender Inequality Index (GII) is the only index which measures differences in the actual level of gender inequality in all the relevant countries included in the sample, we included it in our models. The index is constructed on a scale from 0 to 1, with 0 presenting full gender equality, and 1 full gender inequality (see Eden & Wagstaff, 2021 for more details).

Results

Table 2 gives an overview of all the variables in the models, while Table 3 provides their descriptive statistics and the correlation matrix. In Table 3, no moderate or high correlations between variables stand out. To confirm the absence of multicollinearity issues, we analyzed the variance inflation factors (VIFs). The highest was for Education (1.29), well below levels that would suggest presence of multicollinearity in the models (Belsley et al., 2005). The equations we estimated are reported in Table 4. To test our hypotheses, in light of the non-nested nature of the data, we estimated a cross-classified multilevel models analyzing the interactive effect of foreign ownership and parenthood on Wage for women and men separately (models 2 and 3 in Table 4):

where i is the individual employee, j is the industry, k is the MNE host country, and ε and ζ and η are the error terms.

In Table 4, we used Wage as dependent variable. Model 1 includes the control variables and the linear effects of MNE and Female only, while models 2 and 3 correspond to the models testing for the interactive effect of MNE and Children for women and men, respectively. In each model in Table 4, the positive (i.e., non-zero) variance of the constants at host-country and industry level corroborate industry and host-country characteristics have an (expected) significant (p value = 0.00) effect on wages. In model 1, all control variables are significant (p value = 0.01 for Firm size, p value = 0.00 for all other control variables). Most notably, there is a significant (p value = 0.00) gender wage gap of 19.7% (e0.18− 1) and MNE wage premium of 32.3% (e0.28− 1) in the sample.

In model 2, we test whether the interaction between MNE and Children is significant for the women in the sample. All control variables are significant (p value = 0.00) and being a parent has a negative and significant effect on the hourly wage of women (p value = 0.00), thereby confirming the existence of a motherhood penalty on the hourly wage of women. However, the interaction between MNE and Children is not significant (p value = 0.78), and we thus do not find evidence of a difference between the motherhood penalty in MNEs compared to domestic firms (Hypothesis 1). In model 3, we test whether the interaction between MNE and Children is significant for the men in the sample. All control variables except for Firm size and Women are significant (p value = 0.01 for Union, p value = 0.00 for all other control variables) and being a parent has a positive and significant effect on the hourly wage of men (p value = 0.00). Most relevant, the interaction between MNE and Children is positive and significant (p value = 0.02), thereby confirming our Hypothesis 2.

Given that we tested our hypotheses by including interaction terms in the models in Table 4, we offer an explicit discussion and interpretation of the effect sizes of the relevant estimated coefficients (Meyer et al., 2017). To do so, we estimated the marginal effects of the full range of Children (only for men) on the full range of Wage for both MNE subsidiaries and domestic firms, and then accordingly plotted the fatherhood premium in Fig. 1. As shown in Fig. 1, the fatherhood wage premium is ($1.38 per hour) larger in MNE subsidiaries than in domestic firms. Considering this is a difference in hourly wages, the marginal effects analysis corroborates the economic relevance of the significant moderations obtained.

The fatherhood bonus in domestic firms versus MNE subsidiaries. Note: To make the interpretation more informative, we transformed the marginal effects calculated – given that the dependent variable Wage corresponds to the natural logarithm of the employee’s hourly wage at PPP – to be able to compute the average wage gap/premium in $US/hour

Post hoc analysis

We performed a series of robustness checks that corroborate the findings discussed here, and post hoc analyses showing that our findings can be confirmed across institutional contexts. Furthermore, our analyses show that none of the measures of cross-country institutional distance associated with cultural, administrative, geographic, and economic dimensions significantly affected our results (for more details, see the online appendix).

In light of previous research, mentioned above, on traversing home-host country gender norms within MNEs (cf. Koveshnikov et al., 2019), we also considered the relevance of MNEs’ home-host country differences. Accordingly, in Table 5, we re-estimated the models accounting for the distance in the GII between the MNE home and host country. As the GII is constructed as a direct proportion, we included the difference between the GII in the home and host country in models 4 and 5. In model 5, we indeed found the fatherhood bonus (the relationship between having children and Wage, for men) to be positively moderated by this distance (p value = 0.02). To make these results more informative, we plotted the results of our interaction tests in Fig. 2. Specifically, we estimated and plotted the average marginal effects of Children on Wage at one standard deviation (17% or 0.17) below and above the mean distance of 0, for male employees of MNEs (n = 3265). As the figure shows, the fatherhood bonus is more pronounced when the MNE home country is less gender egalitarian than the host country of the subsidiary by which the employee is employed. However, it is present at all levels of this distance, which corroborates our Hypothesis 2.

The fatherhood bonus at negative versus positive home–host distance in gender inequality. Note: To make the interpretation more informative, we transformed the marginal effects calculated – given that the dependent variable Wage corresponds to the natural logarithm of the employee’s hourly wage at PPP – to compute the average wage gap/premium in $US/hour

Interestingly, in addition to earlier studies suggesting that cross-border interactions may promote egalitarian gender norms and practices in firms in gender inegalitarian countries (cf. Kodama et al., 2018), and conversely inegalitarian gender norms and practices in firms in gender egalitarian countries (cf. Fitzsimmons et al., 2020), our findings hint at the relevance of also considering the MNE home country in this context. MNEs may disseminate gender inegalitarianism resulting from the gendered characteristics of MNEs, of their home countries, or a combination of the two. An alternative, or additional, explanation for the moderating role of distance in gender egalitarianism could be that egalitarian gender norms in some of the MNE home countries dampen the effects of MNE-specific mechanisms on the size of the fatherhood bonus.

Discussion and conclusion

Although the topic of gender inequality has increasingly drawn scholarly attention in the field of IB, the underlying mechanisms which may differentiate MNE subsidiaries from local firms, including those related to parenthood, have been understudied. Inspired by, inter alia, Koveshnikov et al.’s (2019, p. 47) call to “unravel the gendered nature of MNEs”, we considered the defining feature of MNE subsidiaries – i.e., foreign ownership – as a key contingency of parenthood wage gaps. Specifically, we hypothesized the motherhood penalty and fatherhood bonus to be larger in MNE subsidiaries compared to domestic firms. Our analysis shows a significantly higher fatherhood bonus in MNE subsidiaries compared to domestic firms, but no difference in the motherhood penalty between the two types of firms.

The absence of a larger motherhood penalty in MNE subsidiaries compared to domestic firms indicate the (perceived) incompatibility of working for an MNE subsidiary with the demands of motherhood is not a salient source of gender inequality unique to MNE subsidiaries, at least in our sample. One explanation may be that motherhood is a well-known source of gender inequality, and MNEs have been able to mitigate the potential exacerbation of negative effects associated with working for an MNE subsidiary through policies such as maternity leave, paid and on-site childcare and through (creating) awareness of this issue when evaluating their employees and HRM system (Amis et al., 2020; Fuller & Cooke, 2018).

We do find a differential effect of working in an MNE subsidiary compared to domestic firms for fathers, however, which validates our expectation. MNE subsidiaries thus appear more successful in addressing their potential (MNE-specific) negative effects for gender inequality associated with motherhood than for fatherhood. This reflects IB gender research, which has tended to focus on mitigating the disadvantages women face in the workplace. Our study also considered the relevance of mechanisms which may lead men, especially those with children, to accumulate advantages over women, to advance our understanding of how MNEs can facilitate or hinder gender egalitarianism in the workplace. We believe this novel perspective offers much potential for future research. Moreover, our finding that the difference in gender egalitarianism between host and home countries has a significant effect on gender inequality within MNE subsidiaries is of particular interest in the context of IB.

Beyond contributing to the emerging literature on gender in MNEs (e.g., Eden & Wagstaff, 2021; Koveshnikov et al., 2019), we use the latest econometric techniques in our empirical testing, which allow us to control for all industry- and country-level characteristics that contribute to gender-related differences in wages (Graafland & Noorderhaven, 2020). However, although our work provides first large-scale evidence on an MNE-specific fatherhood bonus in comparison to domestic firms, based on unique micro-level data collected across the globe, we could not account for differences in how gender materializes between MNEs, and our data also limits our ability to analyze the diffusion and effects of specific HRM policies and practices in MNE subsidiaries. Moreover, due to the cross-sectional nature of the data and the need to control for employee job level, we cannot uncover how gender affects career opportunities, another important source of gender inequalities (Blau & Kahn, 2017).

Additionally, we recognize that our analysis is based on survey data from the 2013 to 2015 period. We were not able to use more recent data as the WageIndicator information on parenthood wage gaps in MNE subsidiaries in recent years is not available. However, we believe our results still hold significance. The World Economic Forum (2022) estimates that the global gender gap has increased rather than decreased since 2020, and it is thus unlikely the gender inequalities we examined have been resolved over the last few years. That being said, there has been a rise of remote work policies in recent years (Primecz, 2022). Especially in MNE subsidiaries, where gender constructions and effects are connected to international travel and working across different time zones (Tienari et al., 2010), these policies might have been of significance, and therefore warrant more study.

In addition to pointing at important avenues for follow-up investigation, our work also has considerable societal implications. It challenges commonly held assumptions on the causes and cures of gender pay inequity focused on women’s characteristics and life patterns. Policies targeted at women may not mitigate the positive biases towards men and masculinity, and a critical evaluation of gender-related policies in the context of MNEs therefore seems necessary. Sociology scholars have emphasized this is also relevant for other groups of employees who deviate from masculine norms – e.g., those who are transgender, who identify as non-binary, or are fathers who take on non-traditional gender roles – and have been found to face considerable bias in the workplace (Van der Straaten et al., 2023).

Notes

Table A.1 in the online appendix provides a summary of the literature on the motherhood penalty and fatherhood bonus. Research on the topic has gained traction since the start of the century, with 483 publications on the motherhood penalty and 47 on the fatherhood bonus (in Web of Science) and considerable media attention. Studies have primarily focused on the causes of parenthood wage gaps and the moderating (intersecting) effects of individual and family characteristics.

Due to the small firm-level average sample size and in view of the fact that we are not able to identify individual firms with certainty in our empirical setting because they were anonymized in the survey, we restricted the focus to the industry and country levels in the estimations. For a more elaborate discussion and robustness check, see the online appendix.

References

Abraham, M. (2017). Pay formalization revisited: Considering the effects of manager gender and discretion on closing the gender wage gap. Academy of Management Journal, 60(1), 29–54.

Acker, J. (1990). Hierarchies, jobs, bodies: A theory of gendered organizations. Gender & Society, 4(2), 139–158.

Acker, J. (2006). Inequality regimes: Gender, class, and race in organizations. Gender & Society, 20(4), 441–464.

Amis, J., Mair, J., & Munir, K. (2020). The organizational reproduction of inequality. Academy of Management Annals, 14(1), 195–230.

Belsley, D., Kuh, E., & Welsch, R. (2005). Regression diagnostics: Identifying influential data and sources of collinearity. Wiley.

Bidwell, M., Briscoe, F., Fernandez-Mateo, I., & Sterling, A. (2013). The employment relationship and inequality: How and why changes in employment practices are reshaping rewards in organizations. Academy of Management Annals, 7(1), 61–121.

Blau, F., & Kahn, L. (2017). The gender wage gap: Extent, trends, and explanations. Journal of Economic Literature, 55(3), 789–865.

Bøler, E., Javorcik, B., & Ulltveit-Moe, K. (2018). Working across time zones: Exporters and the gender wage gap. Journal of International Economics, 111, 122–133.

Budig, M., & England, P. (2001). The wage penalty for motherhood. American Sociological Review, 66(2), 204–225.

Budig, M., & Hodges, M. (2010). Differences in disadvantage: Variation in the motherhood penalty across white women’s earnings distribution. American Sociological Review, 75(5), 705–728.

Correll, S., Benard, S., & Paik, I. (2007). Getting a job: Is there a motherhood penalty? American Journal of Sociology, 112(5), 1297–1338.

Cukrowska-Torzewska, E., & Matysiak, A. (2020). The motherhood wage penalty: A meta-analysis. Social Science Research, 88, 102416.

Eden, L., & Wagstaff, M. (2021). Evidence-based policymaking and the wicked problem of SDG 5 gender equality. Journal of International Business Policy, 4(1), 28–57.

Fitzsimmons, S., Baggs, J., & Brannen, M. (2020). Intersectional arithmetic: How gender, race and mother tongue combine to impact immigrants’ work outcomes. Journal of World Business, 55(1), 101013.

Fitzsimmons, S., Ӧzbilgin, M., Thomas, D., & Nkomo, S. (2023). Equality, diversity and inclusion in international business: A review and research agenda. Journal of International Business Studies, 54(8), 1402–1422.

Fuller, S., & Cooke, L. (2018). Workplace variation in fatherhood wage premiums: Do formalization and performance pay matter? Work, Employment and Society, 32(4), 768–788.

Goldin, C. (2014). A grand gender convergence: Its last chapter. American Economic Review, 104(4), 1091–1119.

Graafland, J., & Noorderhaven, N. (2020). Culture and institutions: How economic freedom and long-term orientation interactively influence corporate social responsibility. Journal of International Business Studies, 51(6), 1034–1043.

Hewlett, S., & Rashid, R. (2010). The battle for female talent in emerging markets. Harvard Business Review, 88(5), 101–106.

Hodges, M., & Budig, M. (2010). Who gets the daddy bonus? Organizational hegemonic masculinity and the impact of fatherhood on earnings. Gender & Society, 24(6), 717–745.

Kodama, N., Javorcik, B., & Abe, Y. (2018). Transplanting corporate culture across international borders: Foreign direct investment and female employment in Japan. The World Economy, 41(5), 1148–1165.

Koveshnikov, A., Tienari, J., & Piekkari, R. (2019). Gender in international business journals: A review and conceptualization of MNCs as gendered social spaces. Journal of World Business, 54(1), 37–53.

McNulty, Y., & Selmer, J. (Eds.). (2017). Research handbook of expatriates. Edward Elgar Publishing.

Meyer, K., Van Witteloostuijn, A., & Beugelsdijk, S. (2017). What’s in a p? Reassessing best practices for conducting and reporting hypothesis-testing research. Journal of International Business Studies, 48(5), 553–551.

Narula, R., & Van der Straaten, K. (2021). A comment on the multifaceted relationship between MNEs and inequality. Critical Perspectives on International Business, 17(1), 151–170.

Peterson, M., Arregle, J., & Martin, X. (2012). Multilevel models in international business research. Journal of International Business Studies, 43(5), 451–457.

Primecz, H. (2022). Radical changes in the lives of international professional women with children: from airports to home offices. Journal of Global Mobility, 10(2), 226–241.

Shaffer, M., Sebastian Reiche, B., Dimitrova, M., Lazarova, M., Chen, S., Westman, M., & Wurtz, O. (2016). Work-and family-role adjustment of different types of global professionals: Scale development and validation. Journal of International Business Studies, 47(2), 113–139.

Tienari, J., Vaara, E., & Meriläinen, S. (2010). Becoming an international man: Top manager masculinities in the making of a multinational corporation. Equality, Diversity and Inclusion, 29(1), 38–52.

UN. (2020). World investment report 2020. UNCTAD.

Van der Straaten, K., Narula, R., & Giuliani, E. (2023). The multinational enterprise, development and the inequality of opportunities: a research agenda. Journal of International Business Studies, 54(9), 1623–1640.

Van der Straaten, K., Pisani, N., & Kolk, A. (2020). Unraveling the MNE wage premium. Journal of International Business Studies, 51(9), 1355–1390.

WEF. (2022). Global gender gap report 2022. World Economic Forum.

Acknowledgements

The authors are grateful to the WageIndicator Foundation for the data of its web survey on work and wages. They would also like to express their sincere thanks to the editor and the three reviewers for their excellent feedback and guidance in revising our paper.

Funding

The first author’s research appointment when undertaking this study was supported by a grant from the Netherlands Organisation for Scientific Research (No. 023.005.034).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Accepted by Becky Reuber, Deputy Editor, 25 January 2024. This article has been with the authors for four revisions.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

van der Straaten, K., Pisani, N. & Kolk, A. Parenthood wage gaps in multinational enterprises. J Int Bus Stud (2024). https://doi.org/10.1057/s41267-024-00691-w

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41267-024-00691-w